Green hydrogen's international status and GNS H2 strategy

Te Pū Ao, GNS Science is a Crown Research Institute (CRI) enabling and accelerating our transition to a zero-carbon economy by conducting research into Aotearoa New Zealand’s Energy Future on our journey to Net Zero by 2050.

GNS sees green hydrogen (hauwai kākāriki) as an important technology to help decarbonise ‘hard-to-abate’ sectors of our economy that may be challenging with existing technologies.

This webpage outlines the international and local context and activity in the global green hydrogen economy, and outlines GNS' strategic goals and plans for supporting the emerging green hydrogen (GH2) economy across Aotearoa and beyond.

Jump to:

Executive Summary

GNS and the hydrogen economy

The hydrogen opportunity

Global industry trends and significant projects

National and regional roadmaps and projects

Current NZ projects

Summary of GNS GH2 research and capabilities

Social license and resiliency

The hydrogen hype cycle

Providing thought leadership to the energy transition

Conclusion

References

Executive summary

Globally, green hydrogen has garnered increasing awareness from the public and private sectors. Many countries have released strategies and roadmaps to illustrate their long-term plans to develop their green hydrogen economies. By late 2021 the international private sector had announced over US$500 billion in announced projects, with US$200 billion already financed. These numbers continue to grow.

Within New Zealand, the Southern Green Hydrogen project, which has recently been short-listed to two potential partners, provides an opportunity to re-purpose large-scale renewable energy from the Manapouri power station at the end of 2024 for green hydrogen. This green electricity is currently used at the Tiwai Point aluminium smelter.

Southland and Taranaki have shown regional leadership through their development agencies; start-ups such as Hiringa continue to push ahead building infrastructure producing and selling green hydrogen. Moreover, the opening of a 1.1MW green hydrogen plant by Halcyon Power at the end of 2021 was a highlight for hydrogen industry development. Iwi and hapū are showing leadership in the hydrogen revolution with the Te Anau bus project by decarbonising an important tourist route.

GNS has the Kaupapa Hauwai Kākāriki Aotearoa, Green Hydrogen Research Programme and host the Advanced Energy Technology Platform (AETP) Strategic Science Investment Fund (SSIF). These initiatives develop new technologies and support New Zealand’s green energy transition. Organised around our deep materials science capabilities, GNS is partnering with leading international research centres, tangata whenua, local and international industry, and governmental organisations to drive efficiencies in hauwai kākāriki green hydrogen technology and to understand how our society can ensure a Just Transition.

On this webpage, we examine the technical and social context of GH2 and outline our vision and workstreams for supporting its success.

Here is a summary of the six focus areas of our GH2 strategy:

| Focus Area | Objective |

| Research and development | Develop and execute a GH2 research roadmap with global impact |

| Industrial partnering | Leverage Industrial relationships to commercialise our technology |

| Political engagement | Deepen government relationships and provide technical advice |

| Training, skills and pilots | Ensure the workforce of tomorrow is ready for the energy transition |

| Social science and resilience | A Just Transition for all New Zealanders in a resilient energy system |

| Becoming 'The Energy CRI' | Become the CRI known for knowledge of our energy systems |

GNS and the hydrogen economy

GNS is a leading provider of research into Aotearoa’s energy future, promoting and accelerating our transition to a zero-carbon economy. In the energy sector, GNS provides unique capabilities and perspectives on New Zealand by integrating pākehā physical and natural science knowledge alongside mātauranga māori and social science.

In 2022 GNS released its Science roadmap which outlines our strategic direction and vision over the next ten years to 2032. Within our strategic roadmap are four Theme Plans, which leverage our organizational knowledge and capabilities. They include Environment and Climate, Natural Hazards and Risk, and Marine and Land Geoscience, and Energy Futures.

The Theme Plans communicate what will be done to realize our strategy, including individual research initiatives such as the green hydrogen (GH2) programme, whose strategy is the focus of this document. Figure 1 below shows a generalized view of the scope of the strategic roadmap, theme plans, and how this document complements our strategy.

Through our research, GNS aims to build on our strong scientific foundation to help answer Aotearoa’s energy futures questions and overcome scientific challenges. The GH2 team will contribute from cross-functional collaboration within the Earth Resources and Materials, Business Partnerships, Māori & Stakeholder Relations, Commercialisation and Social Science across the organization.

The hydrogen opportunity

New Zealand has committed to transitioning to carbon neutral by 2050 through the Paris Climate Agreement and most recently “Keeping 1.5 Alive” at the COP26 event held in Glasgow, Scotland (MFAT, 2021).

GNS contributes to the national goal of a 100 per cent renewable electricity grid by 2035 (MBIE, 2019) with our geothermal energy and geoscience expertise. However, electrification alone cannot meet our zero-carbon goals and sections of the economy such as heavy transport, thermal industrial processes, and chemical feedstocks require other options.

Hydrogen itself is not a new technology or solution. Since its first discovery, it has gone through multiple so-called “hype” cycles where it has been heavily promoted as an energy carrier but has suffered from technological maturity and public opinion setbacks preventing it from becoming economically feasible or socially accepted. To overcome these difficulties, production and distribution efficiency, and storage challenges must be overcome so it can be integrated and scaled into our existing energy systems. This will allow global economies including New Zealand to effectively increase our energy resilience and meet our climate goals.

GNS believes that we can realize the potential of new ideas that allow hydrogen to compete economically with fossil fuels within 10 years; to contribute to bringing the cost from 2021’s approximate price of USD $5-15 per kilogram (International Energy Agency, 2021) to USD <$2 per kilogram through our Research initiatives and commercialisation activities.

In addition to contributions through core research advances, we will also focus on instilling a passion for Science to students, and understanding the future workforce needs; building the capability of individuals, businesses, iwi, and educational institutions by engaging to help enable our country’s energy future.

Kaitiakitanga of natural resources is a foundational concept for Māori. Transitioning to a zero-carbon economy directly aligns to Indigenous Innovation and Taiao/Haoura Vision Matauranga themes. Māori businesses are active in the energy value chain, with GH2 becoming an opportunity to enter new markets, partner in innovation, and create new jobs.

We will partner with them to further unlock H2 economy opportunities, including high-value job creation, and engage with Māori-owned companies seeking to decarbonise assets/invest in sustainable energy generation.

One of hydrogen’s biggest short-term opportunities is to support the decarbonisation of hard-to-abate sectors such as heavy transport and industrial steel or concrete production. In the medium term, there is the potential to produce green hydrogen or hydrogen-adjacent energy carriers for both domestic and export markets, solving dry-year demand issues, and creating significant green export revenue.

GNS wants to help redefine New Zealand’s energy future as a globally connected, resilient energy exporter with the right balance of renewables, electrification, and green hydrogen. This is achievable through innovation with the potential to bring real-world impact and demonstrating their economic potential and achieving a greater understanding of the social impacts of these changes.

Global industry trends and significant projects

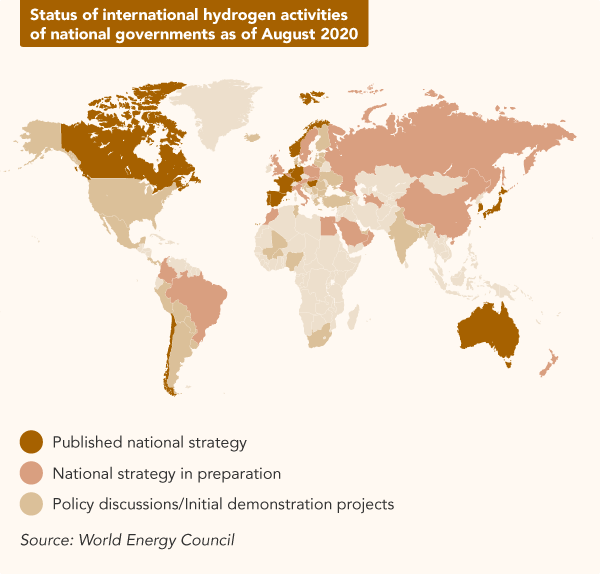

According to the (IEA, 2021), the first recommendation for near-term action on global hydrogen development is for nations and industries to develop roadmaps and strategies outlining how hydrogen can play a role in the future energy mix.

The transition from old products and technologies to new ones, particularly in the eco-innovation sectors, can have strong environmental and social benefits that may not have equally favourable economic or business cases. Therefore, it is due to anticipation in changes to government regulations and future changes in market forces that new technologies receive investment from Industry (Bakker and Budde, 2012). Agencies like GNS engage with stakeholders to understand a complete picture of these new technologies, generate new ideas and pursue commercialisation opportunities through partnerships and collaboration.

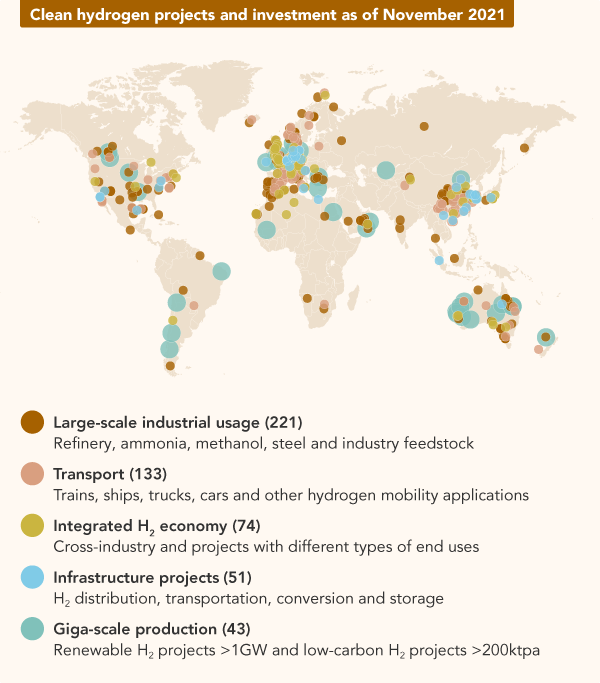

In countries where government roadmaps and strategies have been released, the private sector has increased its commitment to Hydrogen projects, particularly in regions such as Europe, Asia, and Australia, as shown below. For example, Fortescue Future Industries (FFI) based in Australia has been aggressively promoting and expanding its investment in Green Hydrogen in Australia to decarbonise the mining and other sectors (FFI, 2022).

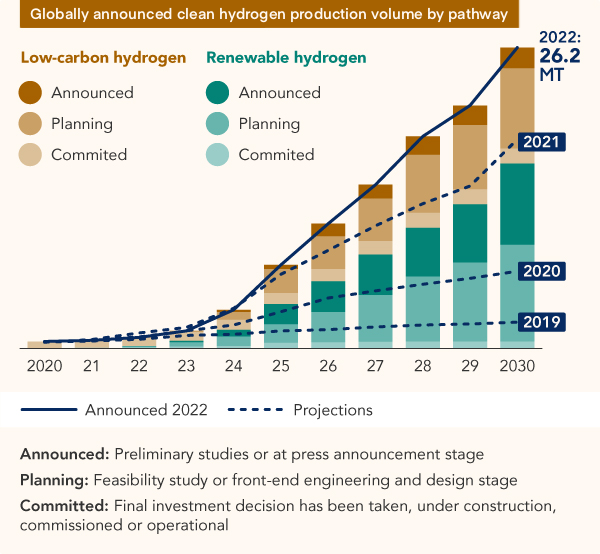

To late 2022, there have been greater than US$500 billion in announcements for global renewable hydrogen projects, with approximately US$80 billion considered “mature” (Hydrogen Council, 2021). The expected capacity by 2030 has therefore increased significantly (see graph below). It is now projected that 260 GW (up from 69 GW July 2021) of capacity has been announced, which is a 500% increase in capacity between February 2021 and January 2022. This represents an additional 475 GW of renewable capacity required globally (IRENA, 2022). For example, In Europe, which has strong policies and government support, Shell launched its largest hydrogen project in Germany with a 10MW capacity in July 2021, with a total cost of approximately 20 million euros (Reuters, 2021). Its next project will be 100MW in size, and electrolyser manufacturers are scaling up their manufacturing to meet these needs (Cummins, 2020).

In Aotearoa New Zealand, the Rio Tinto aluminium smelter at Tiwai Point, which uses 13% of Aotearoa’s electricity with a contract expiring at the end of 2024, presents a compelling opportunity to be one of the world’s first large-scale green hydrogen production projects with an internationally competitive price point (Contact, Meridian, McKinsey and Co, 2021). As well as being a major source of green hydrogen for industry, GH2 produced at scale may also help provide a solution to NZ’s dry-year problem. Years with below-average rainfall result in a deficit of renewable generation and higher carbon emissions, through higher use of coal for electricity generation (Bond, 2021). A final investment decision from Contact and Meridian is expected in late 2023 (Business NZ: Exploring New Zealand's Hydrogen Potential, 2021).

National and regional roadmaps and projects

An effective energy transition requires foresight and planning between macro-actors in the private and public domain, to achieve short and long-term ecosystem development. New sectors or industries require government guidance and investment (Farla et al., 2012), where National institutions such as GNS playing a key role in early technological development.

In September 2019, The Ministry of Business, Innovation & Employment (MBIE) released its green paper “A Vision for Hydrogen in New Zealand” with a consultation process that ended in October 2019. The development of a roadmap is underway and is expected to be released in as a part of the Emissions Reduction Plan (MBIE, 2022). Moreover, MBIE’s “Just Transitions Unit”, has been working in various regions within NZ to create and support new opportunities and understand the impact on different communities and sectors since 2018 (MBIE, 2018). At a regional level within New Zealand, there is considerable variation in strategy, and how development agencies see the use of hydrogen within their respective areas.

Taranaki

The Taranaki region is home to a large portion of domestic energy producers and has shown effective leadership in the energy transition. Its regional development agency, Venture Taranaki, has released a series of energy transition related reports including their Roadmap to 2050 report, H2 Taranaki Roadmap, and Offshore Wind (Venture Taranaki, 2021). The region also hosts Ara Ake as a National New Energy Centre that is focused on Energy Innovators and provides assistance in commercialising energy solutions (Ara Ake, n.d.). Private organizations, such as Firstgas Group, have also released feasibility studies for the transition to 100% Hydrogen across their networks (2020), despite recent delays in the testing and initial pilots within their network (Stuff, 2021) we look forward to future developments in existing gas infrastructure. In the transport sector, Hiringa Energy are prioritizing heavy transport by building New Zealand’s first Hydrogen refuelling network in partnership with Waitomo Group currently under construction and plans to grow nationwide by 2026 (Hiringa, n.d.).

The most recent report from Venture Taranaki entitled “Power to X” based on the well-known term, highlights the opportunities for NZ to create a green energy ecosystem, by producing green products from clean energy, encompassing hydrogen and its derivatives for use both domestically and to drive exports. Moreover, Polytechnics such as the Western Institute of Technology (WITT) Taranaki have recognized the need for training and are shifting curriculums to support future job opportunities across a range of energy uses.

Taranaki is well-positioned to leverage its existing knowledge from its history as an Energy hub through connections, infrastructure and a highly skilled workforce to take a leading role at a national level.

Southland

Southland is another region that has taken a leadership role in decarbonisation, with green hydropower being available via Manapouri powering the Tiwai Point Smelter as noted in Section 1.3. Along with 600MW of base-load Hydro generation, existing high voltage transmission with land, water and a deep-water port are compelling reasons for Contact and Meridian to look at developing an at-scale Hydrogen project (Southern Green Hydrogen, 2021). Its regional development agency, Great South, has been actively engaged with stakeholders to execute its decarbonisation strategy; companies such as Meridian and Contact commissioned a Report by McKinsey & Co. entitled: The New Zealand Hydrogen Opportunity. Murihiku Regeneration, established by Hokonui Rūnanga to work collaboratively with the Crown, is actively working on regional Hydrogen ecosystem development through a working group to identify and develop projects enabling the energy transition. These initiatives include Hydrogen and educational kaupapa and have close ties to the MBIE Just Transitions team (Murihiku Regeneration, n.d.).

Other Regions

While not having publicly released roadmaps or strategies from their respective development agencies or councils, other regions across the country are progressing initiatives that contribute to our hydrogen ecosystem. This includes the ‘Christchurch Hydrogen Collective’ which consists of organizations such as the Christchurch City Council, Christchurch International Airport, and Fabrum in the manufacturing sector. GNS expects that other regions will develop and release decarbonisation strategies to include Hydrogen or its derivatives in future. Ports of Auckland has invested in Hydrogen production and re-fuelling on-site as a part of its target to be zero emission by 2040 (Ball, 2018), and research and innovation actors including all major Universities have existing GH2 capabilities. Moreover, interest from iwi and hapū across New Zealand has been demonstrated. The Ngāti Tāwhaki hapū in Ruatoki near Tauranga is in the early stages of validating the potential of renewables in combination with Hydrogen to improve resilience in the community in partnership with GNS. This will serve as a case study for rural use of green hydrogen with the intention of providing guidance for other iwi and hapū with similar aspirations. In other regions, there is a growing list of organizations that are pursuing Hydrogen in their business plans from transport to fertilizer production among other decarbonisation efforts.

Hydrogen stakeholders in Aotearoa

|

Macro factor |

Stakeholder |

|

Political/Policy |

|

|

Economic |

Contact / Meridian Halcyon Power Hiringa Fabrum Ballance Agrinutrients Toyota New Zealand, Hyundai New Zealand Air New Zealand Emirates Team New Zealand Ports of Auckland, Port Taranaki, Ports of Tauranga Economic development agencies |

|

Social |

Iwi and hapū Murihiku Regeneration Local community groups |

|

Technological (Research, Commercialisation) |

CRI’s including GNS, Callaghan Innovation, NIWA, Scion Universities of Otago, Canterbury, Auckland, Waikato, Victoria Ara Ake Polytechnical Institutes |

List not exhaustive. Primary actors and stakeholders in the New Zealand Hydrogen Ecosystem

New Zealand’s hydrogen ecosystem, compared to its potential, is still in its infancy but is showing a promising future as new technologies develop and new organizations enter the market. There are currently actors that exist that span the Political, Economic, Social, and Technological (PEST) spectrum, outlined in a non-exhaustive list in Table 1. This shows that with stakeholders across each category, there is a significant expertise to deploy projects and continue with research activities to solve major technical challenges on the path to decarbonisation. The ongoing “NZ Inc” approach to collaboration and partnerships is key to ensuring success as the ecosystem develops and is widely adopted across stakeholders.

Current NZ projects

Through partnerships and funding mechanisms, there are numerous projects being undertaken around the country. These include the following significant projects:

- Contact Energy and Meridian have progressed to shortlisting Fortescue Future Industries and Woodside Energy by providing detailed proposals to develop the world’s largest green hydrogen plant.

- A partnership between Tūaropaki Trust and Obayashi Corporation (Halcyon Power) to demonstrate hydrogen production from geothermal electricity with the opening of a 1MW electrolyser plant in December 2021

- MBIE and the German Federal Ministry for Education and Research have announced 3 collaborative projects under the New Zealand–Germany Green Hydrogen Research Programme.

- Announcement by Air New Zealand of a partnership with Airbus to assess hydrogen viability for its fleet

- Development of a refuelling network by Hiringa for heavy transport primarily in the transport corridors of the North Island, along with the supply of Hydrogen fuel cell trucks from Hyzon Motors

- A partnership between Hiringa Energy and Ballance Agrinutrients to produce green ammonia from Hydrogen produced by wind turbines

- Hyundai NZ FCEV (Fuel Cell Electric Vehicle) Xcient truck demonstration project of five trucks

- An electrolyser and refuelling station at the Port of Auckland, which has plans to be a zero emissions port by 2040

Summary of GNS GH2 research and capabilities

GNS has well-established capabilities in materials science.; our long-standing research in materials is the backbone of our Green Hydrogen research programme. Within our MBIE Endeavour and Strategic Science Investment Fund (SSIF) research streams, our main areas of focus are to transform the performance (efficiency, stability and cost) of:

- water electrolysers applying renewable energy sources for electrical input

- electrochemical ammonia synthesis for H2 storage/distribution

We use our national and international connections to leverage wider investment and knowledge from our national and overseas partners who include world-leading theoretical and experimental physics collaborators from Würzburg University (Germany) and the U.S. Department of Energy, catalysis and material design expertise from SABIC (Saudi Arabia) and the University of Canterbury, device optimisation, prototyping, and standardization from CSIRO (Australia) and NTU (Singapore). By working with Māori enterprises, we strive to reveal new technologies and to co-develop investment opportunities for iwi. Moreover, we co-design our research programme with a consortium of domestic industrial partners, including NZ Refinery, Hiringa Energy, Hydrogenics, Firstgas Group, and Obayashi. Internationally, we collaborate with partners in South-East Asia, and always look for more opportunities to expand our network when possible.

We strive to improve societal acceptance/uptake, and our research programme will assess the techno-economic viability of directing renewable electrical energy into water electrolysers, the benefit-cost of exporting GH2, and the socio-economic dimensions of deploying H2-related infrastructure in Aotearoa. We will fund this mainly via our Advanced Energy Technology Platform (AETP) with other funding sources including Endeavour funding through Smart Ideas.

Social license and resiliency

With transitionary changes to our energy system taking place, gaining broad acceptance through the social license is a key part of the transition strategy. As an increasing recognized part of delivering and communicating science, GNS continues to build a core capability in this area. It is defined as ‘a project (or technology) having ongoing approval granted by the local community and other stakeholders’ (Thomson & Joyce, 2008). Gaining a social license requires a building of legitimacy to overcome rejection, building credibility to gain acceptance, and finally being approved through building trust.

GNS Science is a well-established institution with globally recognized expertise in the geosciences, with a widespread reputation. We are therefore well-positioned to use our credibility to influence social acceptance and awareness of hydrogen as a key part of our future energy mix. Rather than seeing social activities as simply a series of tasks, social license through partnerships, and co-development are core elements of the hydrogen programme alongside our science excellence.

It is difficult to determine the social acceptance of green hydrogen as it is primarily in the research domain. There are questions remaining on the economic viability and global efforts by the oil industry to potentially delay decarbonisation (Willis, 2021). However, as media attention increases and pilot projects are completed, there is an opportunity for GNS to connect with communities and communicate the benefits of green hydrogen. This may include communicating how regions can contribute, and the importance of GNS’s research efforts to bring down the cost of production and storage of H2 and its derivatives (such as ammonia) to increase uptake in the future.

Through workshops with industry and academic stakeholders, GNS has generated potential scenarios for hydrogen in Aotearoa up to 2050 its commissioned report, which is outlined below. The range of scenarios varies from little change in the “Steady State” scenario, and “H2 Heaven” at the other end of the spectrum, with middle ground scenarios for more limited regional or remote use and usage limited to industrial processes also possibilities.

To gain the social license for reaching so-called “H2 Heaven”, GNS (and the wider Hydrogen industry) will need to navigate the “rules of the game” for each type of stakeholder, which will differ for each sector. For example, the rules will be different for local iwi, universities, or large commercial entities and GNS must understand each in orders needs to build trust over time and gain credibility. Careful planning and engagement are key to ensure the appropriate strategies for each stakeholder type is maximised.

Ultimately, how these scenarios become reality will depend on a variety of factors. A “Steady State” is more likely in the short term, while “H2 Heaven” is has potential in longer timescales as hydrogen technologies and infrastructure are built over the coming decades to 2050 and beyond.

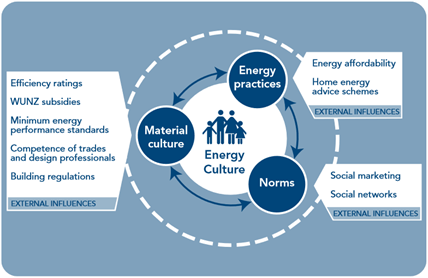

Part of gaining Social license and future programme success will require GNS to identify and understand behavioural drivers. Otago university’s ‘Energy Cultures’ framework is useful in determining what factors can lead to a change in energy behaviour (Barton et al., 2013) and is shown here.

The framework was developed to better understand the drivers of energy-related behaviours, and to determine which areas of the system may benefit from change, and influence energy behaviour in a certain way. The framework visualizes energy behaviour comprising of the interactions between three primary components: norms (individual and shared expectations e.g. environmental concerns, respect for traditions, and social aspirations); the material culture (e.g. physical aspects of a dwelling, including tangible items such as available energy sources, heating devices, and insulation); and energy practices (encompassing both processes and actions such as maintenance technologies, and energy price structures).

These three elements are themselves subject to broader influences which the majority exist outside of the control of an individual. These include energy pricing, standards, subsidies, and social marketing campaigns which can influence a householders’ norms, material culture and energy practices.

GNS is engaging with the University of Otago’s Centre for Sustainability to perform social science research using the Energy Cultures framework. The outputs from this work will help determine what driving factors shape NZ’s energy culture and will feed into future strategy. This in turn will help drive further acceptance and execute ongoing activities and engagement.

The hydrogen hype cycle

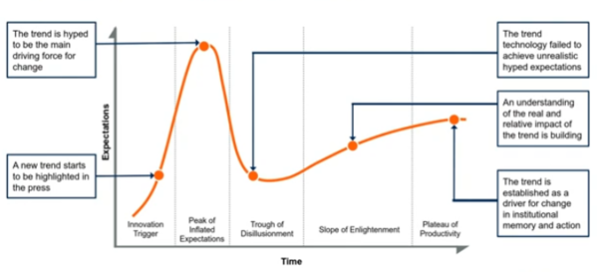

Recently there have been many strategies, roadmaps, pilot projects, and commitments from industry announced globally and within New Zealand. It is important nonetheless to critically assess the viability of hydrogen as a technology. Moreover, as an institution with a longer-term outlook, it is important for GNS to manage its response to hype cycles. A commonly used framework for assessing overhyped versus viable technology is the Gartner Hype cycle (Gartner, n.d.). Its five steps are described below.

Hydrogen was first discovered in the 16th Century (Willis, 2021); it has gone through multiple hype cycles during its use between the 16th-20th centuries via the development of electrolysis in 1789, fuel cells in 1842, and modern usage in Industrial processes or other applications. In the context of the most recent cycle, it most likely began in the late 1990s to early 2000s (Bakker, 2010), with a timeline summary shown in Table 2. Currently, it is likely that the Industry is in the “Slope of Enlightenment” Stage, with renewed interest in the Industry highlighted by strategies and announcements mentioned in Section 1.3. While the Plateau of Productivity may not have been reached, an estimate of when it may begin is noted, along with potential milestones.

|

Hype Cycle Stage |

Dates (approx.) |

Events |

|

Innovation Trigger |

Late 1990’s - early 2000’s |

President George W Bush’s Announced ‘Hydrogen Fuel Initiative’ to reduce reliance on foreign oil California’s zero-emission vehicle mandate Start-ups such as Ballard in Canada for mobile fuel cell applications are formed |

|

Peak of Inflated Expectations |

2008 - 2012 |

Hydrogen programs were set up in the US, Europe, and Japan Demonstration projects involving vehicles were completed Costs were found to be too high to compete with fossil fuels |

|

Trough of Disillusionment |

2010 - 2016 |

Lower media activity Some institutions remained in the industry and continued research such as Hystar Institution Some municipalities, such as Aberdeen, Scotland release hydrogen strategies with a long-term view |

|

Slope of Enlightenment |

2018 -Present |

Hystar in Europe founded in 2020, built on over 15 years of R&D activities from the initial hype cycle MBIE Hydrogen White Paper Tiwai Point smelter call for registrations of Interest (McKinsey, 2021) MBIE funding of GH2 programmes at GNS; backing of GH2 for University of Otago Global releases of roadmaps and strategies 10MW scale electrolyser plant opened by Shell in Germany Large scale international private and public projects announced and financed |

|

Plateau of Productivity |

2025 – 2030 (Projected) |

More announced projects receive finance, built Potential start of Green H2 project at Tiwai Point Continued building of renewable energy generation Scale up of electrolyser size from ~1MW to ~1- MW (Cummins) Intense global research is commercialised and realized |

The hydrogen hype cycle is shown by approximate date and major events to show its movement through the cycle. Taken from various sources.

Balancing hydrogen hype & disappointment

While the Gartner Hype Cycle framework is useful for analysing trends for a given technology, its lack of quantitative data and concrete timelines, or the ability to define the curves, can make it difficult to apply or objectively track. Despite the drawbacks of the framework, GNS can use it to understand the potential for a technology and balance its response to manage expectations with stakeholders. The advantage of the hype surrounding a product or solution is that it can overcome waiting games by major players and serve as a catalyst for their engagement in an innovation race to develop and subsequently commercialize new technology (Bakker and Buddle, 2012). This provides opportunities for CRI’s to take a role in the industry through active engagement; we provide value by co-developing fit-for-purpose solutions, addressing science and technical challenges, and focusing on real innovation in the right sectors which have the highest impact.

As an actor that enables innovation through R&D, it is important for GNS to promote the industry and support its development. This can increase the ‘hype’ by supporting demonstration projects and effectively gaining a social license as previously described. However, it is also important to provide realistic expectations to stakeholders, both internal and external, to avoid overpromising and potential backlash if the technology fails to meet expectations (Bakker & Budde, 2012). If technology is overhyped, the whole community can be affected with outcomes that stretch beyond the individual actor that was promoting the industry or solutions.

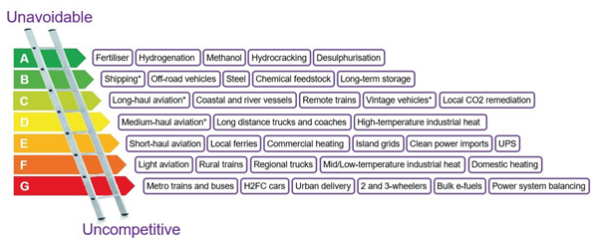

To ensure the highest potential for uptake, and given the technoeconomic challenges of production, storage, and usage of hydrogen, the Clean Hydrogen Ladder (Liebrich, 2021), can be a useful guide to show which sectors have the highest likelihood of viability. The most likely use cases for hydrogen according to the ladder are in the chemical and processes and some forms of transport, while other transport sectors and lower temperature industrial heat are deemed to be less competitive. While the New Zealand context may be different from that of Europe, it nonetheless shows that efforts in hydrogen need to be strategic to provide the most benefit in the long term. Moreover, hydrogen is not the only solution that will solve our energy problems; it needs to be integrated with other forms of renewable energy generation, storage, and utilisation; getting the right mix is critically important. Focus should be on end-use applications that provide the highest efficiency output and deliver the lowest total-lifecycle cost.

Therefore, a balance must be achieved between hype and realistic expectations to ensure the wider community is not affected, or damage to the reputation of GNS is prevented if the technology is ultimately not viable or applied to inefficient applications. Some competencies developed with a certain technology in mind (in our case primarily electrolyser technology), these may prove very useful to apply in other technological fields (Konrad et al., 2012). GNS should engage in ongoing evaluation through robust internal reviews and external engagement activities (including Science advisory and industry stakeholder panels). This ensures our research pathway remains fit-for-purpose, keeping in mind that radical innovation is a lengthy, bumpy process that is not linear, or that research breakthroughs can create new advantages for one technology over another. This co-development and transparent process can ensure that we maintain credibility and provide long-term value in the wider industry and community.

Providing thought leadership to the energy transition

As a key actor within the science and innovation system with a long-term energy system outlook, institutions such as GNS can have a moderating effect on industrial development (Konrad et al., 2012). GNS can provide a valuable and unbiased perspective in the industry by providing strategic thought leadership.

It is important to define the components of thought leadership and incorporate these activities within our hydrogen strategy. Thought leadership is ‘the expression of ideas that demonstrate you have expertise in a particular field, area, or topic’ (Western governors University, 2020). A thought leader in a niche area or industry will regularly release insights through their discourse (or engagement) activities, which in turn will help to gain new partners, clients, press, or employees by leveraging expertise and build trust.

GNS, through its research activities, external engagements, networking and some press mentions have introduced a number of these elements into its activities. It should be noted that COVID-19 has resulted in reduced public speaking and networking events, as these became challenging to accomplish. Instead, GNS has focused on facilitating online meetings and summits where possible and conducting in-person networking and events when appropriate. Further work via a dedicated communications strategy can be undertaken to ensure all avenues are being addressed to provide thought leadership in a meaningful way as we deliver impact through our science objectives.

Conclusion

New Zealand is at a crossroads in terms of delivering on its commitments to climate change. Many models regarding the reduction of emissions use assumptions on future technologies that do not exist or are still in development. Green hydrogen could be an important vector to help close this gap.

New Zealand’s Science system is essential to advancing technology to meet our future needs and create economic opportunities. GNS plays a role in shaping our energy future. We leverage our partnerships and innovative to provide solutions to today’s energy problems and reduce our emissions. We want to ensure that all of Aotearoa benefits from our science and everyone comes along for the journey.

References

Ara Ake. 2022. About New Zealand's transition to a low-emissions energy future. [online] Available at: <https://www.araake.co.nz/about-us/about-us-2/(external link)> [Accessed 14 March 2022].

Bakker, S. 2010. The car industry and the blow-out of the hydrogen hype. Energy Policy, 38(11), pp. 6540–6544.

Bakker, S. and Budde, B., 2012. Technological hype and disappointment: lessons from the hydrogen and fuel cell case. Technology Analysis & Strategic Management, 24(6), pp.549-563.

Ball, M. 2018. Ports of Auckland to build Auckland’s first hydrogen production and refuelling facility. [online] Available at: https://www.poal.co.nz/media/ports-of-auckland-to-build-auckland%E2%80%99s-first-hydrogen-production-and-refuelling-facility(external link). [Accessed 17 March 2022].

Barton, B., Blackwell, S., Carrington, G., Ford, R., Lawson, R., Stephenson, J., Thorsnes, P., Williams, J. 2013 Energy Cultures: Implications for Policymakers. Research Report, Centre for Sustainability, University of Otago, Dunedin, New Zealand. ISBN: 978-0-473-23717-2.

Bond, J. 2021. New Zealand’s use of coal for electricity generation surges. [online] Available at <https://www.rnz.co.nz/news/national/444472/new-zealand-s-use-of-coal-for-electricity-generation-surges(external link)> [Accessed 13 September, 2022].

Business NZ. 2021. Business NZ: Exploring New Zealand’s Hydrogen Potential. [online] Available at: <https://bec.org.nz/wp-content/uploads/2022/07/Exploring-New-Zealands-Hydrogen-Potential.pdf(external link)> [Accessed 14 March 2022].

Chartered Management Institute, 2011. Setting SMART Objectives Checklist 231. Management House.

Contact, Meridian, McKinsey & Co., 2021. The New Zealand Hydrogen opportunity. [online] Available at: <https://www.datocms-assets.com/49051/1626295071-the-nz-hydrogen-opportunity.pdf(external link)> [Accessed 14 March 2022].

Cummins Inc. 2020. Cummins using hydrogen technology to enable renewable energy for public utilities in Washington with the largest PEM electrolyzer in the United States | Cummins Inc.. [online] Available at: <https://www.cummins.com/news/releases/2020/08/26/cummins-using-hydrogen-technology-enable-renewable-energy-public-utilities(external link)> [Accessed 14 March 2022].

Eckert, V., 2021. Shell opens 10 MW German hydrogen electrolyser to boost green fuel output. [online] Available at: <https://www.reuters.com/business/energy/shell-opens-10-mw-german-hydrogen-electrolyser-boost-green-fuel-output-2021-07-02/(external link)> [Accessed 14 March 2022].

Farla, J., Markard, J., Raven, R. and Coenen, L., 2012. Sustainability transitions in the making: A closer look at actors, strategies and resources. Technological Forecasting and Social Change, 79(6), pp.991-998.

Firstgas Group, 2020. Bringing Zero carbon gas to Aotearoa. [online] Available at: <https://firstgas.co.nz/wp-content/uploads/Firstgas-Group_Hydrogen-Feasibility-Study_web_pages.pdf(external link)> [Accessed 14 March 2022].

Fmgl.com.au. 2022. Fortescue Future Industries and Covestro announce plans to enter a long-term green hydrogen supply agreement | Fortescue Metals Group Ltd. [online] Available at: <https://www.fmgl.com.au/in-the-news/media-releases/2022/01/16/fortescue-future-industries-and-covestro-announce-plans-to-enter-a-long-term-green-hydrogen-supply-agreement(external link)> [Accessed 14 March 2022].

Gartner. 2022. Gartner Hype Cycle. [online] Available at: <https://www.gartner.com/en/research/methodologies/gartner-hype-cycle(external link)>. [Accessed 14 March 2022].

Hiringa. N.d. Green Hydrogen Refuelling Network. [online] Available at: <https://www.hiringa.co.nz/hydrogen-refuelling-network(external link)> > [Accessed 27 March 2022].

Hydrogen Council, McKinsey & Company. 2021. Hydrogen Insights A perspective on hydrogen investment, market development and cost competitiveness. [online] Available at: <https://hydrogencouncil.com/wp-content/uploads/2021/02/Hydrogen-Insights-2021-Report.pdf(external link)> [Accessed 14 March 2022].

International Energy Agency, 2021. Global Hydrogen Review 2021. [online] Available at: <https://iea.blob.core.windows.net/assets/5bd46d7b-906a-4429-abda-e9c507a62341/GlobalHydrogenReview2021.pdf(external link)> [Accessed 14 March 2022].

Liebrich, M. 2021. The Clean Hydrogen Ladder. [online] Available at: <https://www.linkedin.com/pulse/clean-hydrogen-ladder-v40-michael-liebreich(external link)> [Accessed 27 March 2022].

Ministry of Business, Innovation & Employment (MBIE). 2018. A Just Transition to a low emissions economy. [online] Available at: <https://www.mbie.govt.nz/dmsdocument/4415-just-transition-to-a-low-emissions-economy-strategic-discussion-cabinet-paper-annex-1(external link)> [Accessed 27 March 2022].

Ministry of Business, Innovation & Employment (MBIE) | Arup, 2019. A vision for hydrogen in New Zealand Green Paper. [online] Available at: <https://www.mbie.govt.nz/assets/a-vision-for-hydrogen-in-new-zealand-green-paper.pdf(external link)> [Accessed 14 March 2022].

Ministry of Business, Innovation & Employment (MBIE). 2021. Energy strategies for New Zealand | Ministry of Business, Innovation & Employment. [online] Available at: <https://www.mbie.govt.nz/building-and-energy/energy-and-natural-resources/energy-strategies-for-new-zealand/(external link)> [Accessed 14 March 2022].

Ministry of Business, Innovation & Employment (MBIE). 2021. Catalyst: Strategic – New Zealand-Germany Green Hydrogen Research Programme. [online] Available at: <https://www.mbie.govt.nz/science-and-technology/science-and-innovation/funding-information-and-opportunities/investment-funds/catalyst-fund/funded-projects/catalyst-strategic-new-zealand-germany-green-hydrogen-research-partnerships(external link)> [Accessed 18 September 2022].

Ministry of Foreign Affairs and Trade (MFAT). 2021. Keeping 1.5 alive. [online] Available at: <https://www.mfat.govt.nz/en/environment/climate-change/influencing-global-action/building-international-collaboration/cop26-and-what-comes-next-for-aotearoa-new-zealand/(external link)> [Accessed 14 March 2022].

Murihiku Regeneration. n.d. Green Energy. [online] Available at: <https://www.murihikuregen.org.nz/our-mahi/green-energy/(external link)> [Accessed 14 September 2022].

Southern Green Hydrogen. 2021. (2021, November 18). Exploring New Zealand's Hydrogen Potential [Powerpoint slides]. https://events.businessnz.org.nz/ExploringNewZealandsHydrogenPotential1(external link)

Thomson, I., Joyce, S.A. 2008. The Social License to Operate: What it is and why it seems so hard to obtain. Slide Deck to accompany Keynote Presentation at the Prospectors and Developers Association of Canada Convention, Toronto, Canada. [online] Available at: <http://socialicense.com/publications.html(external link)> [Accessed 27 March 2022].

Venture Taranaki. 2022. Energy. [online] Available at: <https://www.venture.org.nz/sector-development/energy/(external link)> [Accessed 14 March 2022].

Willis, S. 2021. Developing scenarios for future development of Green Hydrogen (GNS Commissioned Report).